CMS ENERGY (CMS)·Q4 2025 Earnings Summary

CMS Energy Beats Q4, Raises 2026 Guidance 7% Above Street

February 5, 2026 · by Fintool AI Agent

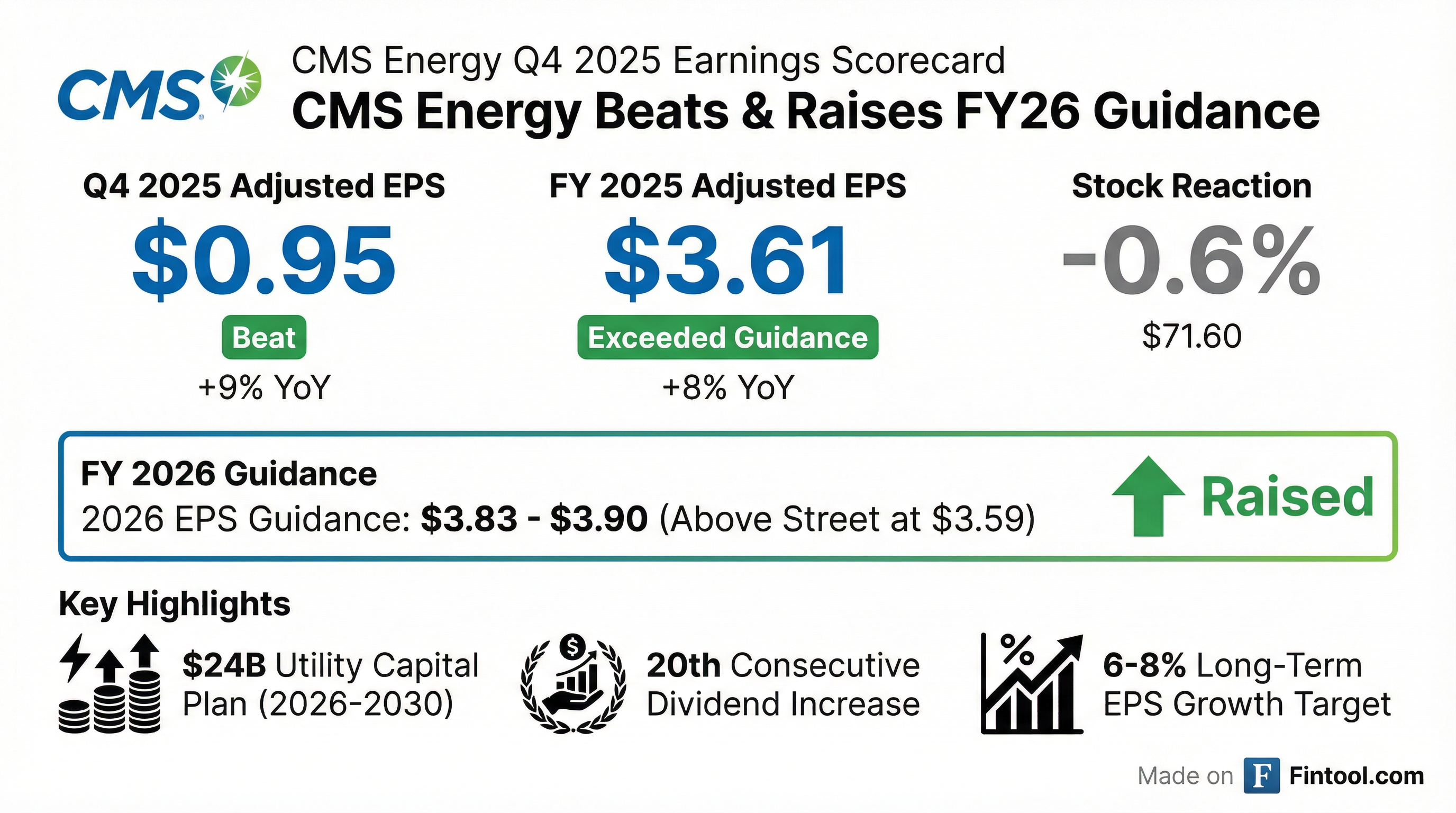

CMS Energy delivered Q4 2025 adjusted EPS of $0.95, up 9% year-over-year and modestly ahead of consensus expectations . The bigger story is FY 2026 guidance of $3.83-$3.90, which sits roughly 7% above Street consensus of $3.59, supported by a $24 billion utility capital investment plan through 2030 . Despite the beat and raise, shares traded down 0.6% to $71.60 as utilities broadly underperformed.

Did CMS Energy Beat Earnings?

Yes — beat on both EPS and revenue.

CMS has now beaten EPS estimates for 9 consecutive quarters, continuing its track record of operational execution. The Q4 beat was driven by normal weather, rates/investment, and cost productivity, partially offset by higher parent financing costs .

What Did Management Guide?

FY 2026 guidance came in 7% above Street consensus.

The 2026 EPS bridge from $3.61 shows:

- +$0.37 from normal weather normalization

- +$0.12 from rates, renewables & investment recovery

- -$0.22 from parent financing, tax & other

Long-term targets reaffirmed: 6-8% EPS growth "toward the high end," ~55% dividend payout ratio over time, and solid investment-grade credit ratings with FFO/Debt in the mid-teens .

What Changed From Last Quarter?

Three notable developments since Q3:

1. Utility Capital Plan Increased by $4B The 5-year (2026-2030) utility capital plan increased to $24 billion, up from $20B in the prior plan, driving accelerated rate base growth .

2. Renewable Energy Plan Approved Michigan regulators approved the 20-year Renewable Energy Plan (REP) adding 8 GW of solar and 2.8 GW of wind, representing an estimated ~$14 billion of capital investment through 2045 .

3. Economic Development Pipeline Expanded The large load pipeline grew to 9 GW of potential demand, driven by diversified economic development across Michigan including data centers and manufacturing .

How Did the Stock React?

CMS shares closed at $71.60, down 0.6% on the day despite the beat-and-raise. The muted reaction likely reflects:

- Sector headwinds: Utilities broadly underperformed with interest rate volatility

- Valuation already elevated: Stock near 52-week highs ($76.45 high vs $66.53 low)

- Execution priced in: 9 consecutive quarterly beats creates high bar for positive surprise

What Did Management Say About the ALJ PFD?

The call's most anticipated topic was the Administrative Law Judge's Proposal for Decision recommending an 8.2% ROE — well below CMS's 10.25% ask and the 9.9%+ typical authorized levels in Michigan. CEO Garrick Rochow was emphatic:

"I'm not concerned about the ALJ PFD at all. It's an outlier. It's not well supported. It doesn't match the environment. It's going to be discounted in this case... I expect an ROE of 9.9% or better."

Rochow pointed to the math: applying a 9.9% ROE to the ALJ's $168M revenue deficiency yields ~$314M — close to MPSC Staff's $317M position . He emphasized that commissioners have publicly stated from the bench that "excess has been driven out" and acknowledged the importance of attracting capital to Michigan .

Key Highlights From the Quarter

Regulatory Wins in Michigan

- Electric Rate Case (U-21870): Filed revised $423M ask with 10.25% ROE; order expected by April 2026

- Gas Rate Case (U-21981): Filed $240M ask in December 2025 with full gas decoupling request; order expected by October 2026

- Storm Deferral: First-ever storm cost deferral approved, providing regulatory certainty

- Large Load Tariff: Approved in November to protect existing customers — data centers pay full share of costs

Customer Affordability

CMS highlighted customer bill management, with utility bills representing only ~3% of household wallet vs ~42% for housing . The company achieved >$100M of waste elimination savings through its "CE Way" continuous improvement program .

Data Center Pipeline Progress

CMS provided significant updates on its large load opportunity:

Management emphasized that none of these data center opportunities are included in the $24B 5-year capital plan — they represent incremental upside to the 10.5% rate base CAGR .

On zoning concerns (referenced in a Wall Street Journal article), Rochow noted that CMS has been operating in Michigan for 140 years and helps "steer data centers into areas where it's more accommodating to growth" . Moratoriums are typically 30-90 days and represent "good due process" — pointing to Mason, Michigan which recently lifted its moratorium with a new zoning ordinance allowing data centers .

NorthStar Clean Energy Upside

The NorthStar segment (DIG capacity + peakers) is expected to contribute $0.25-$0.30 EPS in 2026, benefiting from favorable capacity contracts and renewable project completions . Additional growth drivers include:

- FCM incentives: ~$50M by end of decade from PPAs

- Energy efficiency programs: ~$65M/year of incentives enhanced by 2023 energy law

Capital Allocation & Balance Sheet

The balance sheet remains solid with ~$2.6B in available liquidity and limited near-term maturities . CMS raised $1B from a convertible offering in November 2025 at 3.125% to fund growth .

Management Credibility Tracker

CMS has built a strong track record of under-promising and over-delivering:

This consistent execution supports confidence in the $3.83-$3.90 FY 2026 guide.

Q&A Highlights

On the EPS Growth Bridge (Jefferies): CFO Rejji Hayes walked through the math — 10.5% rate base CAGR plus ~1% from Northstar/FCM yields low double-digit growth, netted down by ~3.5% equity dilution and parent refinancing headwinds (money is "no longer free") to arrive at the 7.5-8% effective guide .

On Affordability & Elections (Wells Fargo): With 10 gubernatorial candidates and affordability a hot topic, Rochow noted CMS's bills are ~3% of household wallet (down 150bps over a decade) . He referenced polling showing 80% of Michigan residents see groceries, not energy, as the cost-of-living issue . On rate freezes: "There's plenty of information that shows rate freezes in Michigan are illegal" — citing Act 3 of 1939 and Public Act 191 of 1982 .

On Decoupling (Mizuho): Electric decoupling is "not permitted" under current Michigan legislation; gas decoupling is the focus of the pending gas rate case .

On Capital Sensitivity (UBS): Every 1 GW of new load requires $2.5B-$5B+ of investment (distribution + supply) . A 1 GW data center conversion would drive ~2 points of reduction in residential bill CAGR .

Forward Catalysts

Bottom Line

CMS Energy delivered another clean quarter with Q4 adjusted EPS of $0.95 (+9% YoY) and FY 2025 EPS of $3.61 exceeding guidance . The real story is 2026 guidance of $3.83-$3.90, sitting 7% above Street consensus and backed by $24B of utility capital investment .

The call's key tension was the ALJ's 8.2% ROE recommendation — which management dismissed as an "outlier" while expressing confidence in a 9.9%+ outcome . Data center progress was a bright spot: the first data center has commercial terms largely finalized and could be online by 2028, with a second in "advanced talks" . CEO Rochow's closing message: "23 years of consistent industry-leading performance... regardless of weather, CEO, governor, legislature, or commission. You can count on CMS Energy to deliver" .

Data sources: CMS Energy Q4 2025 Earnings Call Transcript, Earnings Presentation, S&P Global estimates